Theo Papadopoulos Victoria University

1. Introduction

The contractual and financial relationship between a record company and the performing artist appearing on a sound recording continues to be one of the most controversial issues in the music recording industry. The recording contract is an agreement in which the recording artist agrees to create one or more sound recording titles that will be manufactured, distributed, and promoted by the record company. The controversy surrounds the practice of recoupment, in which a record company recovers a range of expenditure items, such as the cost of producing the master recording, from artist royalties. The terms and conditions of the recording contract reflect the relative strength of the two parties to the bargaining process. Numerous stories circulate of corporate rip-offs in which hit-selling recording artists receive little if any royalty income, despite selling hundreds of thousands, and in some cases, millions of albums. Legendary blues artist Muddy Waters, for example, still owed his record company around $56,000 in unrecouped expenses in 1985 despite producing numerous best-selling hit records. Perhaps in recognition of this inequity, the record company paid his estate around $25,000 in royalties generated that same year, effectively retiring this debt (Holland, 1995). The perceived inequities in so-called “standard recording contracts” have attracted much attention in recent years. A vocal proponent of artist rights is The Future of Music Coalition, advocating new business models and remuneration policies. They would likely concur with the description of recoupment practices as “abhorrent” (J. Rosenthal in Holland, 2001). The formation of the Recording Artist Coalition (RAC) is yet another front on which established record industry practices are being challenged, particularly contract clauses that tie artists to long-term multiple album deals.

This paper investigates the economic principles that underpin the contractual and financial relationship established in a recording contract, and in particular, the risk and return that each party to the investment is exposed. This analysis provides a pictorial view of sales volumes at which a record company achieves breakeven point and artists become recouped. This exploration of the underlying economic relationships facilitates a more informed assessment of the equity of the practice of recoupment. A range of recoupment structures are investigated and income shares are compared beyond the breakeven and recoupment sales volumes for the record company and artist respectively. A consequential benefit is the insight provided into the cost structure and pricing strategies of record companies.

The organization of this paper is as follows. Section two outlines the creation and production process in the music recording industry. This provides the foundation for the evaluation of a typical record company’s cost structure presented in section three. This section includes an analysis of the breakeven (BE) sales volume and the impact of recoupment on record company profit and artist royalty income. Section four illustrates how record companies utilize the practice of procurement to minimize risk, whereby profits on successful titles effectively cross-subsidize speculative investments in new title releases. Section five proposes a more transparent and equitable remuneration structure. Conclusions are presented in a final section.

2. The Creative and Production Process

A song (musical work) is the “raw material” of the music industry. It is the essential ingredient or input into the production of a sound recording: the fixation of a specific performance of a musical work to a sound carrier. A sound recording is the principal output or final product of the music industry. Other outputs include live performances, radio broadcasts, music videos, and sheet music. The creation of the musical work itself incorporates two elements—the lyrics and the musical composition. Copyright in the lyrics and musical composition coexist and may be owned by one or more individuals (the creator/s). The term songwriter is hereafter used to collectively refer to the lyricist and composer. The role of the record company is to transform a musical work into a marketable commodity—the sound recording. The transformation of a musical work into a sound recording can be an expensive and high-risk endeavor.

For most CD/cassette releases, sales of over 250,000 units (all audio formats) are required for a record company to recoup its investment. Yet, over 80 percent of new releases never even reach the breakeven point (Fink, 1996: 94)

Estimates of the proportion of new titles that are financial failures range from 80 to 90 percent. A successful sound recording is, nonetheless, a valuable asset capable of generating tens (or even hundreds) of millions of dollars in revenue. The process from creation of the musical work to the production of the sound recording is summarized as follows. The songwriter typically enters into a contract with a music publisher that is responsible for the commercial application of the songwriter’s musical work. Where the songwriter is also the performer, the publisher may assist in securing a recording contract with a record company. The publisher typically receives a percentage share of all publishing revenues generated from the commercial application of the musical work. The publisher or artist manager negotiates a contract with a record company to record the musical work, that is, to produce a sound recording. The record company invests a sum of money by way of a recording advance paid to the artist or group of artists performing the musical work.1 The artist, in collaboration with the record company, engages a record producer to record the musical work and produce a master recording. It is from the master recording (which is typically owned by the record company) that multiple copies of the sound recording are manufactured, either in CD pressing plants and/or audiocassette duplication plants.

Distributors are responsible for the timely delivery of the product to retailers, typically coinciding with a marketing and promotion campaign for the sound recording. The marketing campaign incorporates a range of activities including advertising, publicity, radio airplay, music TV, and live performances. Attending concerts, listening to radio, and watching music television programs are consumption activities in their own right and generate income for publishers, songwriters, and performers alike. However, each of these outputs are intrinsically linked to the key output of the music industry, the sound recording, and form part of a coordinated marketing and promotion strategy designed to maximize record sales.2

For most first-time recording artists, there is little room for negotiation. The result is what has become known in the industry as a standard recording contract. The key clauses relating to remuneration and recoupment favor the record company and essentially identify a set of circumstances within which the record company can reduce artist royalty pay-ments. This bias reveals a fundamental truth about the record company – artist relationship; artist royalties are perceived as a cost of production and are accordingly minimized. The investor relations department of Universal Music Group identifies the building blocks of a strong recording business to include long-term contracts and cross-recoupment of albums (Vivendi, 2002). The former strategy ensures that successful artists are tied to the record company for multiple titles, typically on terms dictated by the original contract. The latter ensures that recoupable expenses not recovered on one title can be recovered from artist royalties payable on another. For example, consider an artist who is recouped on the first title and begins to receive royalty income. If a second title is released, royalties payable on the first title will be used to recoup expenses relating to the second title. This can considerably erode artist income and, if the follow-up album is unsuccessful, enables the record company to minimize risk and maximize returns to its investment.

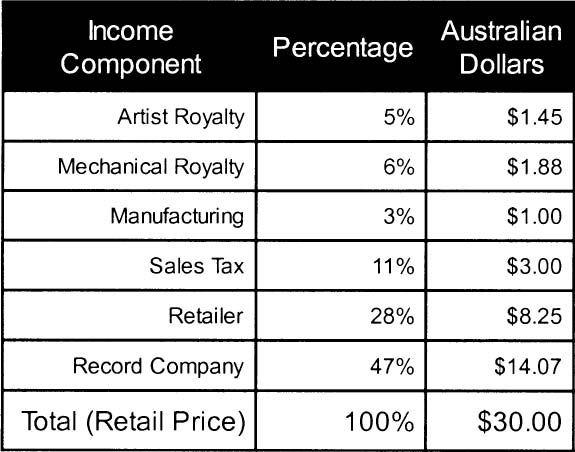

These contractual and financial arrangements determine the distribution of income from the sale of a sound recording as presented in Table 1. The record company is obliged, under contractual arrangements, to pay a royalty to the publisher (songwriter) and the performing artist for each copy of the sound recording sold. The royalty paid to the publisher is called the mechanical royalty and is paid in recognition of the songwriter’s copyright

Table 1. Distribution of income from a CD.

Source: Dwyer, 1998. NB: Figures in this table relate to Australian data.

in the musical work embodied in the sound recording (in Australia: $1.88 [Australian Dollars] or 6% of the retail price). In addition, the recording contract with the performing artist obliges the record company to pay an artist royalty in recognition of the artist’s copyright in the specific performance of the musical work embodied in the sound recording.

The manufacturing (duplication) cost is relatively insignificant at $1.00 [Editor’s Note: all costs in this paragraph are in Australian dollars], and represents only 3% of the retail selling price. The Australian government collects $3 per CD in sales tax (11%) while the retail margin is 28% of the retail price ($8.25). By far the largest share of the retail price, 47% ($14.07), accrues to the record company. The record company share might seem somewhat excessive, particularly given the intellectual property is created by the artist and/or songwriter. Closer inspection of the cost components reveals that record company profits may not be as lucrative as they might first seem. This revenue will contribute to the recovery of a range of costs including distribution ($0.63), administration ($1.71), publicity ($2.16), marketing ($1.41), and production of the master recording ($0.75), leaving the record company with an estimated earning (before tax) of approximately $6.66 per unit.3 Moreover, profits on successful titles must be sufficiently large to cover losses on unsuccessful titles. Having outlined the basic contractual and financial relationships, we now investigate the cost structure of a record company more closely.

3. Physical and Intellectual Costs of Production

To understand the cost structure of the recording sector of the music industry we need to have a clear understanding of the nature of the product. Record companies are multi-product firms. Each artist’s sound recording is unique, the production of which requires a substantial investment by the record company. The relevant quantity measure for a record company is therefore not simply the number of units sold but also the number of sound recording titles (referred to as albums or records) released per time period. Each title involves a distinct production activity in its own right, including an investment in research and development (R&D).

The role of the Artist and Repertoire (A&R) department is to “discover” the next superstar artist, capable of creating one or more high-sell-ing or “hit” records. The A&R activity is akin to the R&D activity in the pharmaceutical sector in which scientists conduct research to discover the next wonder drug. While there exists an oversupply of artists, rivalry be-tween record companies to sign specific artists thought to have superstar potential can be quite intense. That A&R is an inexact science is evidenced by the numerous artists that have been passed over by some record companies and artist managers who go on to become international superstars (examples include the Beatles and Savage Garden). Negotiation between a record company and the artist manager culminates in a recording contract, the duration of which typically covers a number of sound recording title releases.

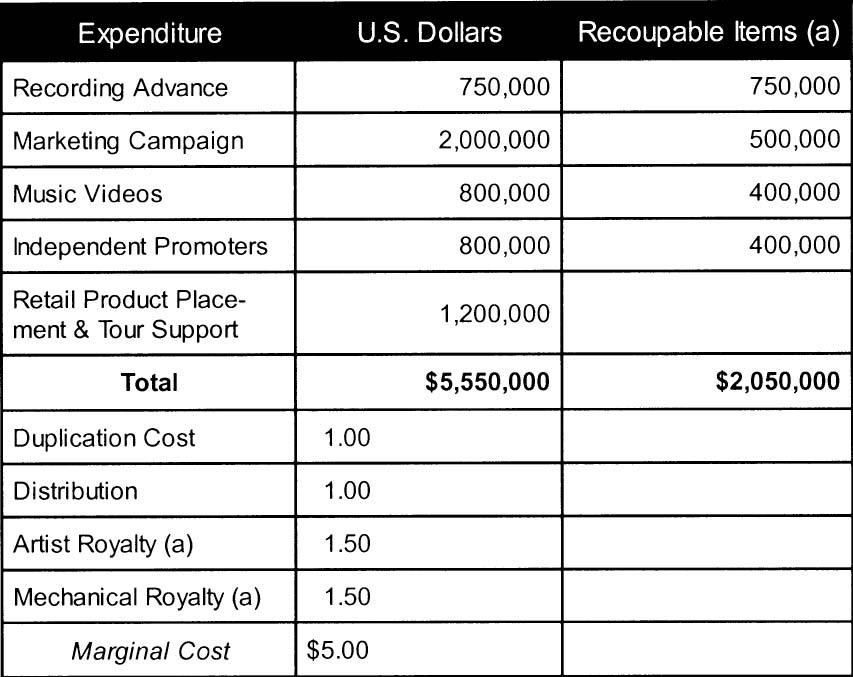

Investment opportunities (artists and their songs) are evaluated and ranked according to a set of financial criteria. The A&R department acts as a filtering system for the record company, short-listing prospective investment opportunities and presenting these to management for consideration. Only a small proportion of artists secure recording contracts. The record company subsequently invests in the development and production of the artist’s sound recording. Table 2 presents establishment costs and other expenditure items for a sample title produced by an anonymous record com-pany.4 The financial strength of individual record companies varies considerably, as does the level of investment in the production and marketing of individual sound recordings. For illustrative purposes we assume that the data contained in Table 2 depicts a typical sound recording title released by one of the big five multinational record companies which is expected to be an international hit record (the majors have a combined global market share of around 85%). A total of $US5.55 million dollars, excluding manufacturing (duplication) and distribution costs, was invested in the development and marketing of this particular sound recording title. This represents a fixed cost and exposes the record company to considerable financial risk.

The recording contract typically provides for an advance to cover the recording costs, $750,000 in our example, which is then recouped from future record sales by way of a deduction from artist royalties. In this way, the record company partially covers the risk arising from the unpredictable demand for a new sound recording title release. The record company also invests in the marketing and promotion of the artist’s sound recording, which incorporates television and radio advertising, as well as a series of promotional performances. In this example, the record company invested $2 million in the marketing campaign for the title. Another $1.2 million was spent on retail product placement, tour support, and other advertising measures during a six month advertising campaign. This followed the release of the title in an attempt to boost sales (Philips, 2001). It is widely acknowledged

Table 2. Cost of Production: Sample Sound Recording Title.

Source: Philips (2001)

(a) Hypothetical values included for illustration purposes.

in the industry that radio airplay is a key determinant of sales. For this reason a further $800,000 was expended on independent promoters, whose job it is to lobby radio programmers to have a song from a new title added to a radio station’s play list.5 Most recording contracts will require more than just recording-related costs to be recouped from artist royalties. Recoupable items may include promotion, tour support, video production, and independent promoters, and can vary from 50 to 100 percent of each expenditure item.6

There is considerable controversy over this aspect of recording contracts. Many artists, and their managers, believe that record companies use their considerable market power to exploit them and impose unfavorable contract terms and conditions. Recoupment of marketing and promotion expenses is seen as shifting both the cost and risk of the investment onto the artist. Having recouped the recording cost from artist royalties it is ar-gued, in some quarters, that the artist should own the master recording, since copyright law generally bestows ownership to the party that pays for the recording. Particularly vocal on this issue is singer-songwriter Courtney Love who describes what she believes to be grossly unfair recording contracts as piracy. This somewhat creative definition of piracy is based on the view that these contracts amount to stealing an artist’s copyright and income. Love outlines a hypothetical scenario in which a band receives a 20% royalty (which she acknowledges is impossible to negotiate) on the sale of 1 million copies of a new sound recording title. Despite a $1 million dollar advance, most of which is spent on production of the master recording, each member of the band receives a relatively modest $45,000 income from the advance. The royalties that would otherwise have accrued to the band are used to recoup the initial advance and a range of marketing and promotional expenditures. The emotion and animosity that this issue generates with some artists is illustrated in the following quote:

Story after story gets told about artists, some of them in their 60s and 70s, some of them authors of huge successful songs that we all enjoy, use, and sing, living in total poverty, never having been paid anything. Not even having access to a union or to basic health care. Artists who have generated billions of dollars for an industry die broke and uncared for. And they’re not actors or participators. They’re rightful owners, originators, and performers of original compositions. (Love, 2000: 3)

Record Companies, in their defense, argue that the contractual arrangements, including the practice of recoupment, are necessary given the considerable uncertainty and consequential risk associated with investing in a new artist and sound recording title. Indeed, the data released to The New York Times for the Philips article, was an attempt to demonstrate the size of the individual investments and the considerable financial risk borne by individual record companies. In this view, the mega-profits that artists point to (generated on a relatively small percentage of titles) are necessary to recover the substantial losses incurred on the majority of titles that fail to break even. The major record companies contend that only around ten percent of title releases are financially successful (Philips, 2001).

The size of the investment in the production and promotion of the sound recording will be commensurate with the projected sales of the specific title, and this will vary from artist to artist, and reflect the financial strength of the individual record company. With this cautionary note in mind, the expenditure data presented in Table 2 prove useful in evaluating a record company’s cost structure and the sales required to break even on an artist’s sound recording title.

4. Record Company Costs and Revenues

The foregoing discussion is useful in facilitating a better understanding of the physical and intellectual property characteristics of the product and the risk undertaken by artists and record companies alike. A construction of costs and revenues utilizing elementary microeconomic tools facilitates a comparison of the firm’s breakeven sales volume to the volume of sales at which the artist is recouped. The familiar cost function for a typical firm is:

TC = TFC + TVC (1)

where TC is total cost, TFC is total fixed (establishment) cost and TVC is total variable cost. For a record company, TVC for an artist-specific title has a number of components and are assumed to be:

TVC = MPC.Q + DIST.Q + RA.Q + RP.Q (2)

where MPC is the marginal physical cost (that is, the manufacturing or duplication cost), DIST is the distribution cost, RA is the artist royalty, R is the publishing (or mechanical) royalty and Q is the quantity of sound recordings manufactured. Substituting equation (2) into (1) we obtain:

TC = TFC + MPC.Q + DIST.Q + RA.Q + RP.Q (3)

Differentiating equation (3) with respect to Q we obtain:

dTC/dQ = MPC + DIST + RA + R= MC (4)

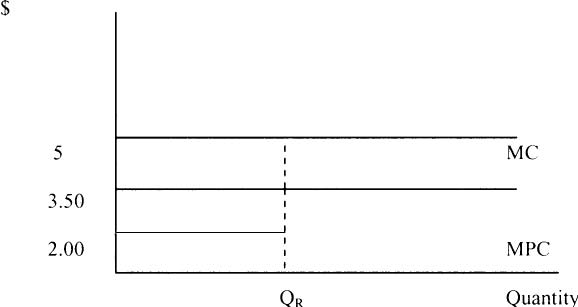

Equation 4 depicts the record company’s marginal cost of production (dTC/dQ) (which we represent with the symbol MC) and clearly illustrates the physical component (MPC + DIST, hereafter represented by the symbol MPC) and intellectual property component (R + RP) of the sound recording. These components of MC are presented in Figure 1.

Figure 1. Marginal cost of production.

To illustrate the breakeven point for our representative record company, we assume a wholesale selling price (published price to the dealer, or PPD) of $10. The firm’s profit function is:

Π = P.Q – [TFC + (MC.Q)] (5)

where Πis economic profit and P is the selling price (PPD). Substituting data from Table 2 (where fixed costs of $5.55 million are expended and marginal cost is $5) we obtain:

Π= 10.Q – [5,550,000 + 5(Q)] (6)

The breakeven point occurs at a volume of sales where total revenue

(P.Q) is equal to total cost (TFC + MC.Q). Breakeven sales can be identified by solving for Q in equation 6, when Π= 0. Setting profit to zero and rearranging (6) we obtain:

10Q = 5,550,000 + 5Q

5Q = 5,550,000

Q = 1,110,000

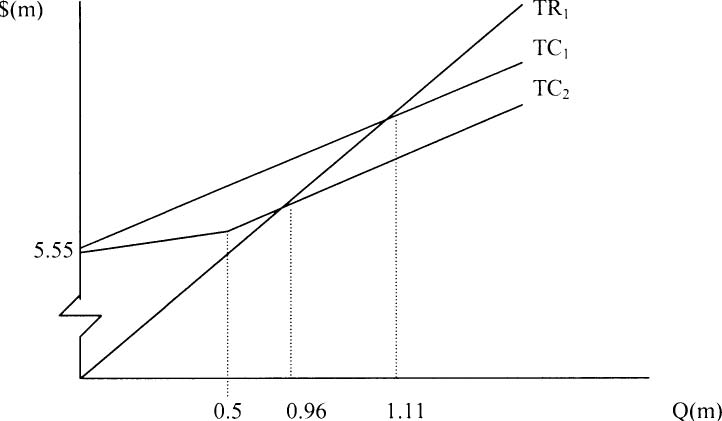

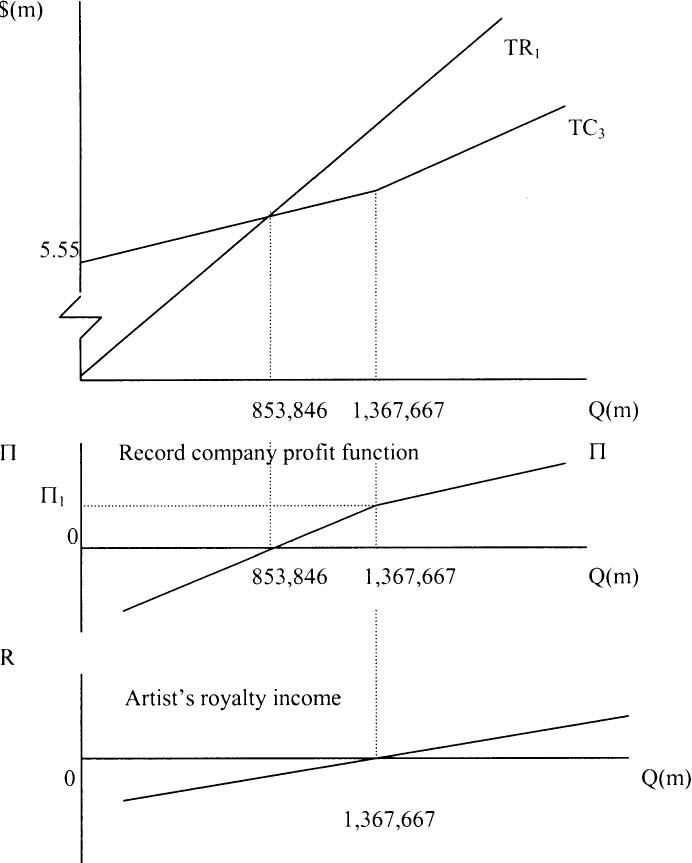

That is, the breakeven volume of sales for our sample title is 1.11 million sound recordings. This is depicted diagrammatically in Figure 2 as the intersection of TR1 (depicting the total revenue function) and TC1 (the total cost function). This would appear to be the volume of sales required for the record company to recoup its investment; and any sales beyond this volume generating a profit.

Figure 2. Breakeven sales: recoupment scenario one.

Recall, however, that the contractual arrangement with the artist enables the record company to recoup its investment in the production of the sound recording and other marketing and promotion costs from artist royalties. To illustrate how the contractual arrangement regarding the sharing of investment costs (recoupment) between the artist and record company can impact their respective financial positions, we develop two scenarios. In scenario one only the recording advance is recouped, while in scenario two, the more likely scenario of additional recoupable expenses will be considered.

Recoupment Scenario One

Assuming a contractual arrangement in which only the recording advance is recoupable, the artist will be recouped at a sales volume of 500,000 units. This sales volume is simply derived by dividing the value of the recording advance by the value of the artist royalty (750,000/1.50 = 500,000). Technically the record company is obliged to pay the artist a royalty on each and every copy of the sound recording sold. In reality, the artist commences with a debt of $750,000 and the record company, having already advanced $750,000 to the performing artist, does not pay artist royalties on the first 500,000 sales. TC1 in Figure 2 therefore overstates the actual cost function faced by the record company. The marginal cost of production up to a sales volume of 500,000 will be $3.50 (MC -R)7. For every unit sold beyond 500,000 the record company must pay the artist royalty. This produces a discontinuous marginal cost curve as depicted in Figure 1, where MC is $3.50 up to QR (500,000 units), the sales volume at which the artist is recouped, and $5.00 thereafter. As a result, the total cost curve (TC2) has a gradient of (MC -RA) up to 500,000 units and a gradient equal to MC thereafter. The point of inflection of TC2 in Figure 2 coincides with the discontinuous section of the marginal cost curve and represents the volume of sales at which the artist is recouped. The practice of recoupment means that, in reality, the record company’s breakeven sales volume is not 1.11 million units, but instead occurs at a volume of sales equal to 960,000 units and coincides with the intersection of TR1 and TC2 in Figure 2. As depicted, the artist begins to earn royalty income (on each sale beyond 500,000 units) before the record company’s breakeven point (at 960,000 units). From the record company’s perspective, which has invested substantial income in the development of the title, this would be an unacceptable proposition. In practice, contractual arrangements typically allow the record company to recoup a range of costs inclusive of the recording advance and it is to this scenario that we now turn.

Recoupment Scenario Two

In this scenario, we assume that the contractual arrangement enables the record company to recoup the range of expenditure items as depicted in Table 2. The items listed in column three total $2.05 million. As such, the artist will remain unrecouped until the title sells ($2,050,000/1.5=) 1,366,667 units. The record company will face a marginal cost curve of $3.50 up to 1,366,667 units and $5.00 thereafter. This produces the total cost function depicted by TC3 in Figure 3 and the breakeven point for the record company is now 853,846 units8. In contrast to recoupment scenario one, the record company generates a profit well before the artist is recouped. As depicted, the volume of sales at which the artist is recouped (1,366,667 units), the record company generates a profit of Π1.

Clearly, the practice of recouping a proportion of establishment costs from artist royalties effectively shifts some of the financial risk from the record company to the artist, thereby reducing the breakeven point and improving profitability. While this has been a bone of contention between artists and record companies for many years, it is noteworthy that, as depicted in recoupment scenario one, the artist begins to earn royalty income after 500,000 units which is well before the record company reaches breakeven point, let alone earns a profit. This situation is reversed in recoupment scenario two with the record company earning profits before the artist is recouped. The challenge is to find an appropriate balance of financial risk and income sharing that is equitable for both parties.

Figure 3. Breakeven sales: recoupment scenario two.

The anonymous record company illustrated in this example, sold around 100,000 units of the sound recording title and incurred a substantial loss. The artist was dropped from the record company’s artist roster and no additional investment in the title or artist would take place. Recording advances are typically non-refundable and the artist’s debt is effectively retired. For the record company, the small percentage of successful investments (between 10 and 20 percent of titles released) must cover the losses incurred from all unsuccessful releases. This suggests that, while a record company will generate profits on sales of a specific title beyond 853,846 units (as depicted in Figure 3), it will not break even on overall title releases until profits generated from successful releases cover losses incurred on all unsuccessful releases. This cross-subsidization of speculative investments in new sound recording titles is now investigated more thoroughly.

5. Cross-Subsidization as a Risk Management Strategy

The record company is a multi-product firm, releasing multiple sound recording titles per time period. There are two countervailing forces that will determine the specific number of titles released. One the one hand, rivalry between record companies and the desire to sign the largest proportion of successful artists, will encourage record companies to increase the number of record contracts offered per time period and thereby, increase the number of titles released. On the other, high establishment costs combined with stochastic demand encourage record companies to limit the number of titles released per time period. For the record company, the probability of releasing an unsuccessful title and incurring losses is compensated for by the probability of releasing a successful title on which substantial profits can be generated.

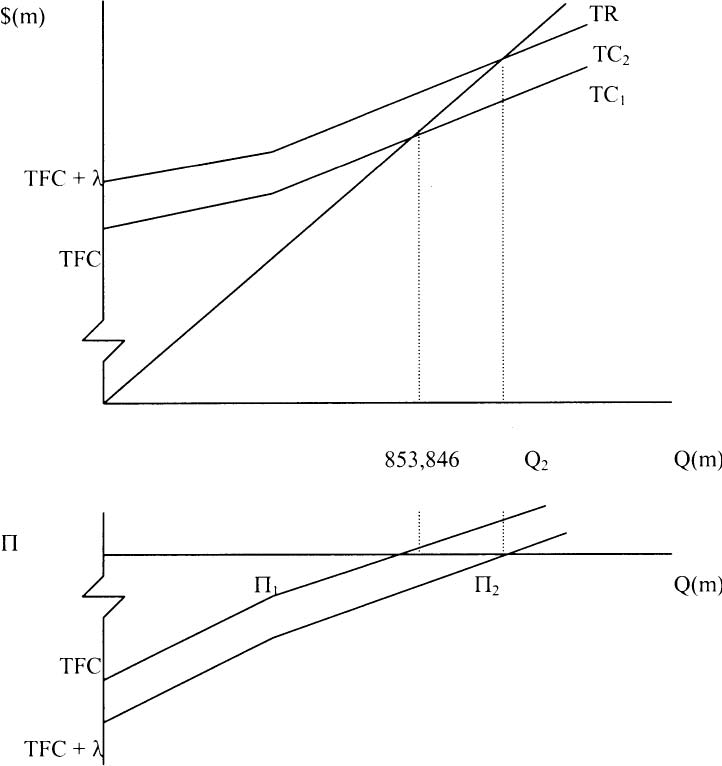

To illustrate the effect of stochastic demand on the firm’s decision making let us consider a hypothetical scenario in which a record company faces an investment environment in which, based on previous experience, only one in five title releases is profitable, two titles break even while the remaining two titles incur a loss. The losses incurred by the record company on unsuccessful releases must be covered by profits generated on successful title releases. In this sense, profits from successful releases subsidize speculative investments in new artists and sound recording titles. This means that the cost function of the successful title will incorporate a margin to cover the expected losses incurred on unsuccessful title releases.

These losses may be thought of as unrecouped R&D investment or establishment costs necessary to release multiple titles per time period. To capture this cross-subsidization we can conceptualize the cost function presented in equation (3) incorporating a variable that represents the unrecouped investment in unsuccessful releases. That is,

TC = λ+ TFC + MC.Q (7)

where λ is a margin required to capture the unrecouped investment (loss) incurred on unsuccessful title releases. This would shift the TC curve upward at every output level by a value of λand increase the breakeven sales volume for a successful title. The recoupment of losses on unsuccessful titles (λ) shifts the title specific total cost curve upward to TC2, as depicted in Figure 4, raising the breakeven sales volume from Q1 to Q2. The profit function shifts downward by a factor of λ, and as depicted, the record company will not generate profits until sales of the successful title exceed Q2.

Considered from the artist’s perspective, there are a large number of artists, only a very small percentage of which will receive record contracts. Of these, only about one in ten will be successful. In this context, artists’ investments of time, money, and effort would, in economic terms, seem somewhat irrational. The balance of probabilities is stacked against them. This seemingly irrational behavior might be explained by the desire for fame, wealth, and the promise of a glamorous lifestyle. For others, the opportunity costs might be relatively insignificant or they may be risk takers. The non-refundable recording advance further encourages artists since (opportunity costs aside) the financial risk is borne by the record company. Few artists fulfill the dream. The foregoing illustration demonstrates that an investment of millions of dollars expended on recording, marketing, and promotion does not guarantee success. Recall that an artist does not receive income (beyond the initial recording advance) until he or she is recouped. What might be perceived by consumers and aspiring superstars as success (music videos, radio airplay, and tens of thousands of record sales) may in fact be a failed investment, for both the record company and the artist alike.

6. Towards a More Equitable Remuneration Model

There are numerous models that one can propose, limited only by the imagination of the negotiators. Despite this, there have evolved a number of industry practices, the prevalence of which has resulted in the so-called

Figure 4. Breakeven sales with cross-subsidization.

standard recording contract. While there is, in practice, considerable variation between contracts, many features are fundamentally the same. What is perceived as equitable will depend very much on which side of the negotiating table one sits. The proposed model follows logically from the preceding analysis and is based on the underlying principles of transparency and equity. Transparency, whereby all expenditure associated with the production and release of the new sound recording title is made explicit, is necessary for both parties to clearly identify the breakeven sales volume. While equity is subjective, an equitable contract is here defined as one in which both parties share in the profit generated from the commercial exploitation of the musical work beyond the breakeven point. That is, each party ought to begin to enjoy a return for its respective intellectual property rights and financial risk beyond the breakeven point. The recoupment scenarios outlined above do not satisfy this definition of equity. Moreover, transparency with respect to costs is not a feature of the typical record company – artist relationship. Record companies have traditionally been secretive about what is considered to be commercially sensitive information. Indeed, audit provisions in recording contracts typically exclude an audit of manufacturing data, severely restricting the artist’s ability to conduct an informed assessment of the financial reporting responsibility of the record company.

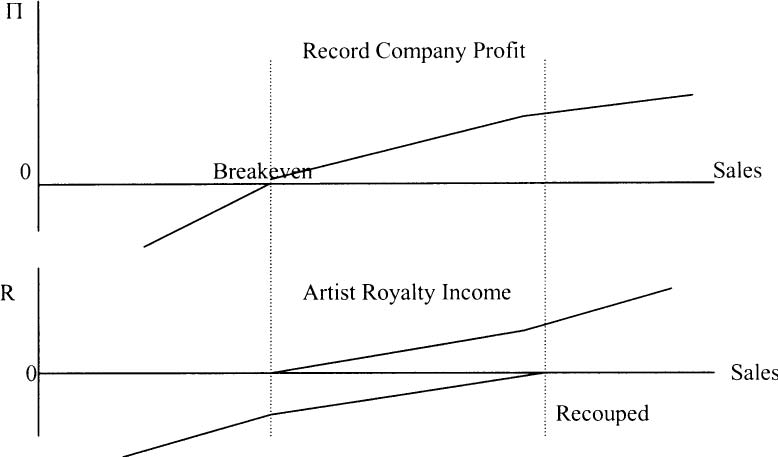

By definition, establishment costs are recovered at the breakeven point. To ensure that both parties enjoy a reward for their respective intellectual property beyond this threshold level of sales, the recording contract could allow for a fraction (κ) of the artist royalty to be paid to the artist (that is, quarantined from recoupment) while the balance (1-κ) is recouped and used to retire the artist’s debt to the record company. That is, the profit contribution per unit sold (Π) beyond the breakeven point would be:

Πc = PPD – (MPC + DIST + RM +κRA) (8)

cA

Three stages of production would be identified and the value of κ adjusted accordingly. At sales volumes below the breakeven point κ= 0, while κ< 1 beyond the breakeven point where the artist remains unrecouped, and finally κ= 1 for sales beyond the volume of sales required for the artist to be recouped. The value of κ between the breakeven and recoupment points would be negotiated between the parties and would ensure that both the record company and artist share in the rewards of a successful title release. Its value could also reflect the need for the record company to recover losses on unsuccessful titles.

To illustrate let’s assume that the parties agree to allocate a fraction of royalties to help recover unrecouped losses on unsuccessful titles (λ), say 0.2, and the balance to be split equally until the artist is recouped (κ= 0.4). This profit-sharing model requires a payment of κRA, in this case 0.4 ($1.50) = $0.60, for each sale beyond 853,846 units (the breakeven point). Accordingly, beyond the breakeven point the artist would have two royalty income functions as illustrated in Figure 5. In practical terms this means that the artist’s royalty statement would identify two royalty payments beyond the breakeven point—one that is quarantined from the practice of recoupment (and accompanied by a check) while the other continues to repay the recording advance and other mutually agreed expenses. It might also be deemed necessary to continue to apply a discount on royalties to recover λ beyond the recouped sales volume to some agreed threshold sales. From the artist’s perspective, this may be a small price to pay for the transparency required to implement this remuneration model. This still leaves unanswered the difficult question of what are “reasonable” expenses to be recouped.

Figure 5. Income sharing model.

The proposed model differs from current practice in one important respect: both the artist and the record company share in profits generated by the artist’s sound recording beyond the breakeven sales volume. Its adoption requires a revolution in the traditional approach to the contractual and financial relationships, where the artist royalty is not seen as a cost to be minimized. Rather the artist would in actuality become a business partner who is rewarded for an essential contribution to the creation of a marketable product. Given the range of costs that have traditionally been recouped from artist royalties, it seems reasonable that artists (through their management) should participate in the formulation of production and marketing plans and be privy to all such costs associated with the marketing and distribution of the specific titles. This would go some way to reducing the animosity that often arises between these parties. The greatest obstacle to the implementation of such a model is that the balance of power in the negotiation process for new recording artists lies with the record company, which effectively sets the contractual terms. Failing some commercial imperative to do so, record companies may be unwilling to embrace the transparency requirements that this model requires. Digital distribution of sound recording over the Internet provides the opportunity for artists to circumvent record companies and distribute music directly to consumers. While business models in the new economy are still evolving this may be the catalyst for change.

7. Conclusions

The analysis presented in this paper reveals a fundamental truth about the relationship between the artist and the record company. For the record company, artist royalties are a cost of production, which any profit-maxi-mizing firm will attempt to minimize. However, a contractual arrangement that enables a record company to generate a profit while the artist remains unrecouped is to place greater value on financial capital than on intellectual capital. The proposed profit sharing model enables record companies to continue with the practice of recouping a proportion of establishment costs against artist royalties at a rate of 100% up to the breakeven point and at some mutually-agreed fraction between the breakeven point and the volume of sales at which the artist is finally recouped.

To the extent that this lowers profit on successful titles, record companies might respond by adopting a more conservative stance and reduce the number of speculative investments on new sound recording title releases. While this may favor successful artists, it could result in a lowering of musical diversity as artists performing in non-mainstream music genres find it increasingly difficult to secure a recording contract. Altruism aside, there seems no compelling reason for successful artists to effectively subsidize speculative investments in what are, in the majority of cases, commercially unsuccessful investments. While the proposed model might seem intuitively appealing and compelling in its logic, it demands a level of transparency and cooperation not hitherto observed in this industry.

Endnotes

1 Hereafter we use the term artist to describe either a solo performing artist or a group of artists (band).

2 This is a simplification of the organizational structure of the music industry and focuses on the production and distribution of the sound recording. Other income generating activities, including live performances and merchandising, are not dealt with here.

3 These estimates are based on estimated proportional share of cost components reported in the Prices Surveillance Authority (PSA) (1990) inquiry into the price of sound recordings.

4 Executives of the U.S. offices of Universal, Warner, Sony, BMG, and EMI provided Philips, (2001) with access to internal budgets and cost-analysis data for dozens of recording projects. Information disclosed was subject to a confidentiality agreement to retain anonymity for both the record company and the artist. The data in Table 2 details actual expenditure by one of the major record companies for an artist specific sound recording title.

5 This practice was introduced in the 1980s and lead to the payola scandal in which the majors were accused of attempting to raise barriers to independent record companies by raising the cost of radio airplay.

6 The recoupable items and values presented in Table 2 are hypothetical values as contract details were not provided for the sample title.

7 Mechanical royalties are normally quarantined from the practice of recouping costs from royalties.

8 10(Q) = 5.55 + 3.5(Q), for Q we obtain 853,846 units.

References

Dwyer, P. “Legal Aspects of Doing a Record Deal.” International Music Industry Conference Proceedings, Victoria University, Australia, 1998.

Fink, Michael. Inside the Music Industry: Creativity, Process and Business. New York: Schirmer Books, 1996.

Holland, B. “Righting Past Wrongs,” Billboard, March 1995.

Holland, B. “The Dirtiest Word in the Record Business,” Billboard, June 2001.

Inquiry into the Prices of Sound Recordings. Australia: Prices Surveillance Authority, 1990.

Love, Courtney. “Courtney Love Does the Math.” Digital Hollywood Online Entertainment Conference, Los Angeles, 2000. Unedited transcript of conference presentation.

Philips, C. “Record Label Chorus: High Risk, Low Margin.” Los Angeles Times, 2001.

Vivendi-Universal. “Investor Relations.” 2002. http://finance.vivendi universal.com/finance/strategy/businessunits.cfm.

DR. THEO PAPADOPOULOS is Program Director, Bachelor of Business– Music Industry at Victoria University, Australia. He is an experienced educator and author of numerous training materials, textbooks, and research articles. Papadopoulos has recently published a book on trade related aspects of the music recording industry and is a member of the MEIEA executive board serving as Australasian Liaison. He is a member of the FReeZACentral Management Committee.